Va Home Loan Refinance With Cash Out

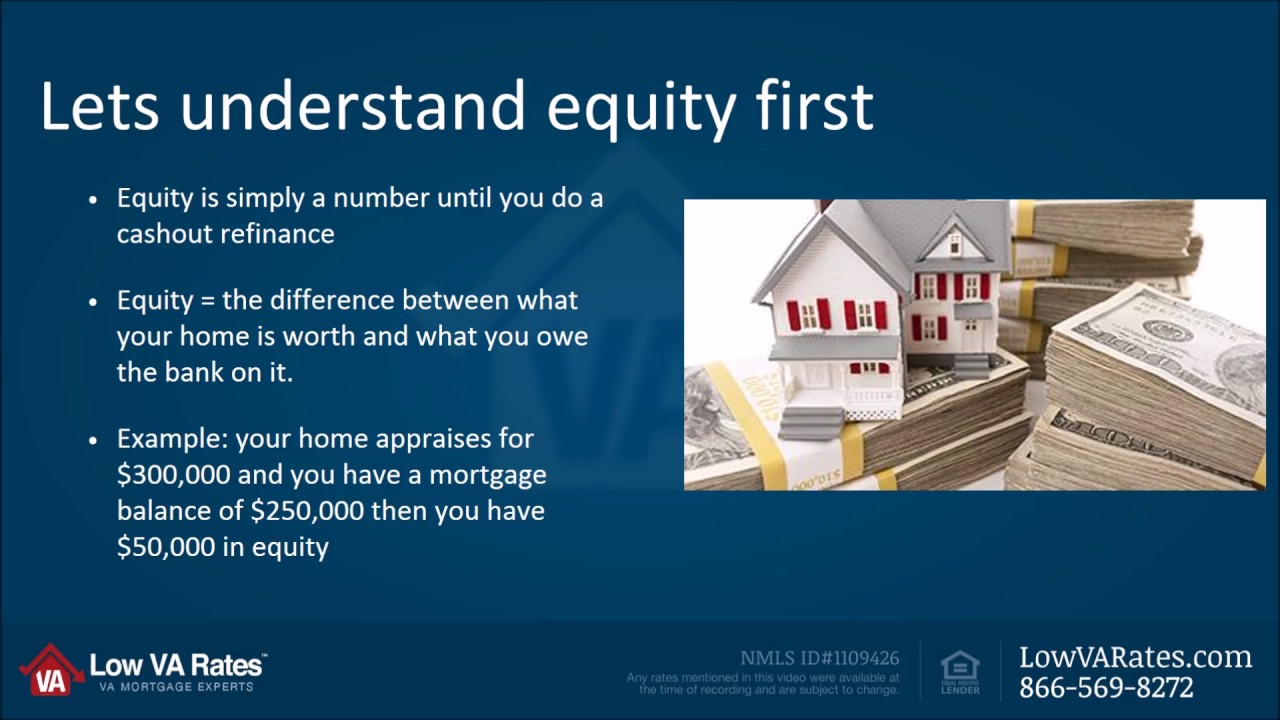

The VAs Cash-Out refinance loan gives qualified veterans the opportunity to refinance their conventional or VA loan into a lower rate while extracting cash from the homes equity.

Va home loan refinance with cash out. In the advanced settings on the refinance. Cash Out Refinance loans allow you to take cash out of your home equity to take care of concerns like paying off debt funding school or making home improvements. Home Loan Options For Active Military Veteran Reservist or National Guard.

Often called a Streamline refinance the Interest Rate Reduction Refinance Loan IRRRL option is great for existing VA Loan holders who are looking to realize significant savings and take advantage of lower interest rates. Interest rate reduction refinance loan. This includes refinancing of construction loans.

Have an existing VA-backed home loan. In addition to standard closing costs for a cash-out refinance both a cash-out refi and an IRRRL require the borrower to pay a VA funding fee which is 05 percent for an IRRRL and 23 percent. With cash-out refinancing you refinance your current home loan for more than the amount you currently owe and keep the extra money to spend on things like home projects or paying off other high-interest debt.

VA has categorized refinancing loans as the following. Cash-out refinance loan Want to take. 1 Interest Rate Reduction Refinancing Loan IRRRL.

You can use the cash out option to refinance an existing first mortgage loan of record on the home you currently own and occupy. Compare the Top VA Streamline Refinance Lenders Secure A Low Rate Now. Ad Begin Verification Online and Get Connected With Top VA Refinance Lenders.

Take Advantage of the Government GSEs Mortgage Relief Product Before Its Too Late. Home Loan Options For Active Military Veteran Reservist or National Guard. Apply Quick Easy.