Va Home Mortgage Cash Out Refinance

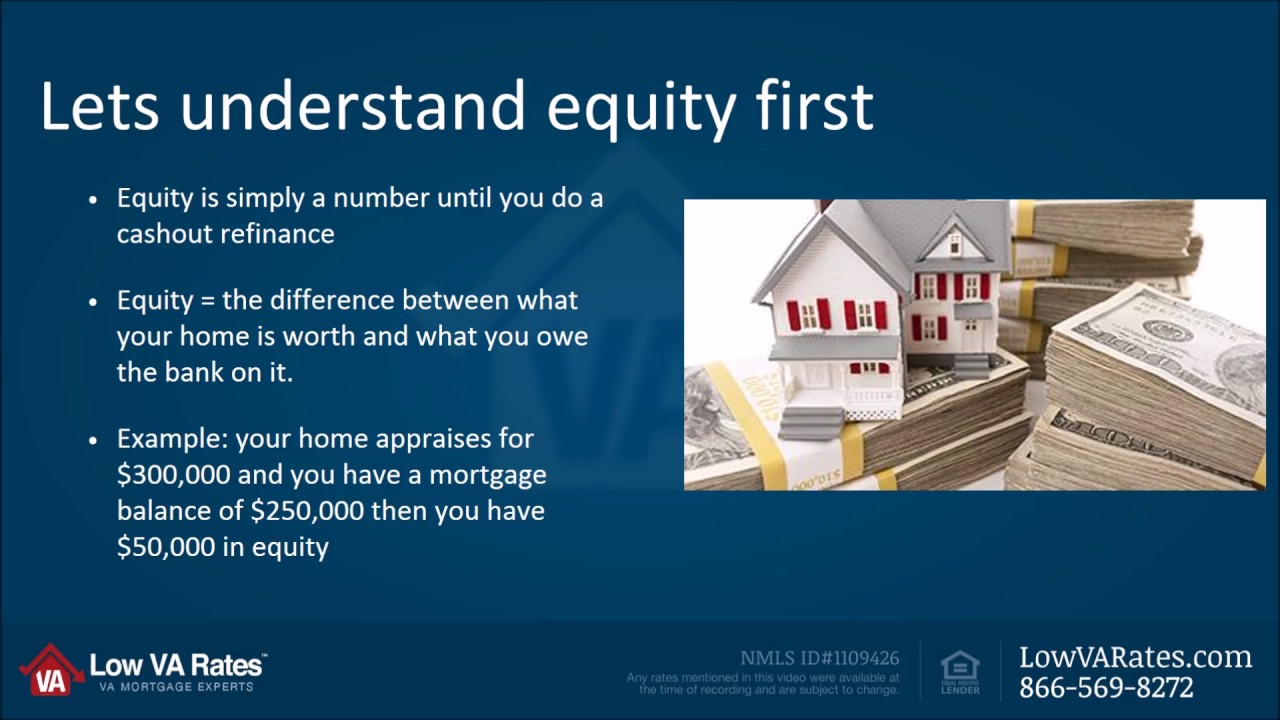

The VA Cash-Out refinance loan replaces your existing mortgage.

Va home mortgage cash out refinance. If youre using a VA home loan to buy build improve or repair a home or to refinance a mortgage youll need to pay the VA funding fee unless you meet certain requirements. Find the One for You. Interest rate reduction refinance loan.

Ad Compare the Best Cash Out Refinance Rates. In addition to standard closing costs for a cash-out refinance both a cash-out refi and an IRRRL require the borrower to pay a VA funding fee which is 05 percent for an IRRRL and 23 percent. Ranking Criteria Trusted by Over 45000000.

Ad Begin Verification Online and Get Connected With Top VA Refinance Lenders. Save Money and Even Get Cash-Out. The VAs Cash-Out refinance loan gives qualified veterans the opportunity to refinance their conventional or VA loan into a lower rate while extracting cash from the homes equity.

This rule amends VA regulations pertaining to all cash-out refinancing. Ad Compare 2021s Best VA Home Loans. Get your certificate of Eligibility COE Your loan officer can easily pull this for you in a few minutes.

A VA cash-out refinance loan replaces your current mortgage with a loan backed by the US. Ad Compare Top Mortgage Refinance Lenders. Home Loan Options For Active Military Veteran Reservist or National Guard.

Heck for Recent Refinance Mortgage Rate Drops. 3 TYPE II Cash-Out Refinance is a refinancing loan in which the loan. Ranking Criteria Trusted by Over 45000000.