Va Home Refinance 100 Cash Out

Find the One for You.

Va home refinance 100 cash out. FHA conventional or USDA. Veterans Get a VA Cash out up to 90 of Homes Value. Rates as Low as 225 245 APR Reduce Rate Pay off Debt Get Cash out and Defer up to 2 Payments.

Lets say youre using a VA-backed loan for the first time and youre buying a 200000 home and paying a down payment of 10000 5 of the 200000 loan. Save Money and Even Get Cash-Out. A VA cash out refinance will increase your mortgage principal.

Ad Stop Searching Start Saving On That Monthly Mortgage Payment. 100 financing with no Private Mortgage Insurance. A VA-backed cash-out refinance loan lets you replace your current loan with a new one under different terms.

The Act required VA to promulgate regulations for cash-out refinancing loans specifically refinancing loans in which the loan amount will exceed the payoff amount of the loan being refinanced. Youll pay a VA funding fee of 3135 or 165 of the 190000 loan amount. Ad Compare the Best Cash Out Refinance Rates.

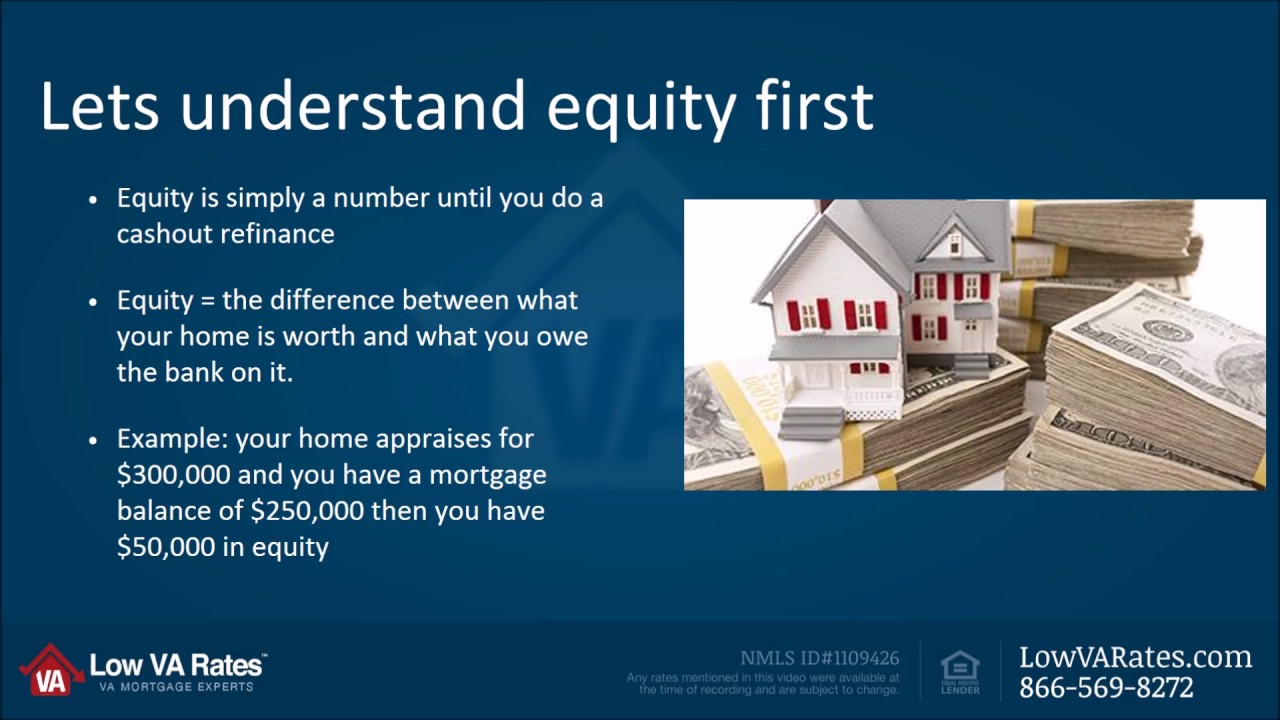

The higher interest rate is put in place to defer someone from using this program. When VA may guarantee a refinancing loan. With the VA Cash-Out refinance you have the opportunity to turn the equity in your home into cash.

It Doesnt Hurt To Check. Compare Lenders Make Your Mortgage More Affordable. Heres how a VA 100 Cash Out Refinance works.