Va Home Refinance With Cash Out

Ad Did You Know With A VA Loan You Can Refi Up To 120 of Your Home Value.

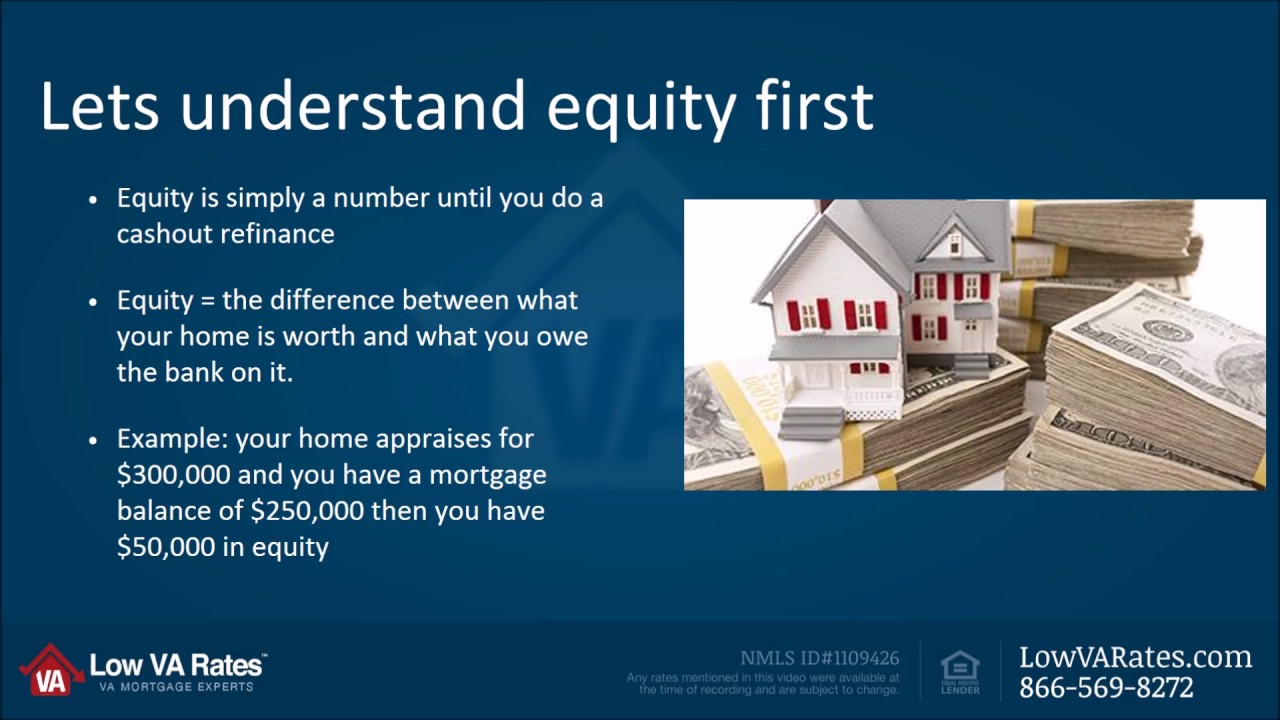

Va home refinance with cash out. Youll go through a private bank mortgage company or credit unionnot directly through usto get a. 2 TYPE I Cash-Out Refinance. A Cash-Out refinance is an option for those with a VA or conventional loan looking to take advantage of their homes equity to access cash for home.

Using your VA home loan benefit can help you purchase a home at a competitive interest rate. A VA cash-out refinance replaces your existing VA mortgage with a new VA loan. If youve accumulated 10000 in credit card debt with an.

Ad Compare the Best Cash Out Refinance Rates. Home Loan Options For Active Military Veteran Reservist or National Guard. Find The Best Cash-Out Refinancing Lenders Lock In A Low Interest Rate Today.

If you have an existing VA-backed home loan and you want to reduce your monthly mortgage paymentsor make your payments more stablean interest rate reduction refinance loan IRRRL may be right for you. Cash-out refinance loan Want to take cash out of your home equity to pay off debt pay for school or take care of other needs. Ad Review 2020s Best VA Home Loans.

Refinance an existing VA-guaranteed home loan at a lower interest rate. This includes refinancing of construction loans to permanent loans. VA has categorized refinancing loans as the following.

Cash Out Refinance loans allow you to take. A refinancing loan made to refinance an existing VA-guaranteed home loan at a lower interest rate. Find out if you can get a VA-backed cash-out refinance loan.